TransitionZero Media Release: Under Embargo

Not for publication prior to 23/11/2023 00:00:01 GMT

Cables to change the world

The economic benefits of transmission investments to decarbonise global electricity supply

Summary

Grids are net-zero lifelines. It is now widely understood that electricity grids will need to be expanded globally to meet the ambitions of the Paris Agreement. However, the amount of deployment necessary on a country-by-country basis and the potential economic benefits is uncertain.

Building grids could save nearly $3 trillion in the net-zero transition. Reinforcing transmission lines within and between countries reduces the amount of costly generation and storage infrastructure needed, saving the global economy trillions in transition costs. The savings could be greater still when the system resilience and macroeconomic benefits of grids are considered.

Many countries could become net exporters of clean electricity. Transmission facilitates several nations across the world to tap into their vast solar and wind resources, allowing surplus generation to be exported to other countries. This creates new export revenue streams.

Grids create new corridors of global trade. Expanding transmission systems reshapes the global power network and creates many new trade relationships, primarily an east-to-west supply corridor. This highlights the importance of multilateralism between countries at a time of increasing protectionism.

Ten cables to change the world. Based on the model results and a database containing more than 800 large transmission cables, we create a shortlist of ten cables which, if built, could play an outsized role in decarbonising global electricity supply at minimal cost to consumers and taxpayers.

Climate finance for grid investments. Our study highlights and quantifies the emission reduction benefits of grid investments. This can help steer the flow of climate finance towards this sector by showing these investments are both cost-effective and transformational.

Power grids are the lifelines of net-zero

Power grids are the backbone of almost all of the world’s social and economic infrastructure. The things we depend on daily—digital communication, offices, manufacturing, hospitals, food and water production—all require vast quantities of electricity around the clock, and these critical social systems could not function without the electricity supplied to them by power grids.

The role of power transmission systems is becoming ever more important as countries begin intensifying decarbonisation efforts. Achieving net-zero will require switching various forms of energy demand to electricity. For example, cars with internal combustion engines will be displaced by electric vehicles, while heat pumps will replace fossil-based heating systems. The adoption of clean energy technologies requires us to produce and transport more electricity than we have ever done before. Power grids therefore will not only do the heavy-lifting to decarbonise the power sector, but also other critical sectors such as transport, industry and buildings.

We now understand that a massive scale-up of electricity transmission infrastructure is needed to realise a net-zero world economy. Left unchecked, the ambitions of the Paris Agreement could be jeopardised.

Constructing the grids of the future: where, when and how?

While the construction of new grid infrastructure is an urgent global priority, the current state of play in the global transmission sector is not properly understood, owing in part to a lack of freely available global data and decision-making tools. This lack of information creates uncertainty about the scale of grid infrastructure required to meet country-specific energy and decarbonisation goals.

Grid infrastructure is an important enabler for more efficient deployment of zero-carbon energy technologies. Transmission allows us to build electricity production sites in regions with high renewable energy potential and move the generated power to regions where it is to be used. This is a particularly important characteristic in regions that have poor natural renewable resources or lack the land to develop energy infrastructure. Yet, it inevitably involves searching for solutions beyond national borders and as such requires careful navigation of costs, trade-offs and opportunities.

Using the cutting-edge Future Energy Outlook (FEO) platform, TransitionZero has conducted a first-of-its-kind global analysis of electricity grid requirements to 2040 at a national and subnational scale. The model covers 163 countries. Of these, 153 are modelled at the national level and 10 at the subnational level. The latter therefore includes inter-regional electricity trade within the country in addition to between countries. We have compiled the most complete open-source dataset of existing and planned grid capacities, comprising 800 transmission pathways. Using this data as a starting point, we then assessed how much new generation, storage and transmission infrastructure is needed to achieve net-zero in the power sector by 2040 under two scenarios (Table 1). There are two main types of transmission projects: (1) links between electricity markets and (2) links from a power generation capacity to an electricity market. For the moment, our modelling focuses only on the first kind as it allows for bidirectional power trade and entails unifying electricity markets.

Both of our scenarios depict potential strategies for the global power sector to become net-zero by 2040. The underlying model includes constraints ensuring zero emissions across the entire power system. The important distinction between the two scenarios is that one allows for the expansion of transmission infrastructure beyond their levels today, while the other does not. In doing so, we make a significant contribution to the debate on transmission: to build or not to build? For the very first time, this allows us to unravel the opportunities and trade-offs that come with a globally integrated power network. Here’s what we have found:

Building grids could save $3 trillion

Even without accounting for the system reliability benefits of transmission, we find that bolstering transmission capacity worldwide could save the global economy nearly $3 trillion by 2040 in transition costs (Table 2). This saving is based on the difference in total costs between the two scenarios we have modelled here (NGS and GUS). For context, the total system costs for the NGS and GUS scenarios across the entire model period are $80 trillion and $77 trillion respectively. The benefits of transmission represent 4% savings in total system costs. There are a number of reasons why transmission leads to lower total costs. Firstly, transmission allows for the best placement of wind and solar resources. Expansion of transmission networks facilitates the global power system to tap into the best resources of wind and solar. Building renewable assets in regions with the most sun and wind allows us to get the most value for money from our investment.

Secondly, transmission reduces the amount of generation and storage required. A result of more efficient wind and solar asset performance is that we need to build less of these assets overall. Transmission allows surplus electricity generated in one area to be efficiently distributed to areas where demand is higher, diminishing the need for storage capacity. Compared to the No Grids (NGS) pathway, our analysis shows that transmission expansion reduces the required capacity of zero-carbon technologies by 9% and 21% in China and North America respectively.

Looking beyond the cost implications, the wider social benefits of optimising the deployment of solar, wind and storage infrastructure cannot be understated. Less power generation and storage infrastructure means less land, less material demand for critical materials, and fewer permitting hurdles to cross. This may result in other non-technical benefits, including the preservation of environmental carrying capacity on the land and the formation of new service markets. Transmission expansion can also support social and economic development by creating more grid-related jobs and new investment models that cater to transmission expansion.

Nevertheless, it must be acknowledged that building out electrical grids will be no easy task. Although power lines are less land-intensive in comparison to other energy infrastructure, they can have very low social acceptance, particularly in OECD countries. Capitalising on the opportunity will require coordinated economic and regulatory reforms between countries and regions.

Transmission creates corridors of clean power flow

Enabling the advancement of transmission systems reshapes the global power network, fostering new trade relationships among nations and continents. Figure 1 illustrates all major power lines (>1GW) globally in 2040, as well as hotspots of zero-carbon power capacity. Here, we see a major set of transmission cables that spans across Asia and Africa, as well as clusters across Europe, North America and Latin America. While most new lines facilitate the flow of clean power from east to west, there are also new latitudinal power lines built from North Africa to Europe.

Figure 1. Major transmission lines and zero-carbon capacity projections globally in 2040 under the GUS scenario

A net-zero power sector with a reinforced power grid results in staggering amounts of cross-border power exchanges in 2040 (Figure 2). China becomes the world’s largest electricity exporter, supplying nearly 5000 TWh of clean power to its neighbours, representing a near 294-fold increase from today’s levels. Transmission cables also unlock export potential in many countries where there are no power exports today, such as: Sudan, Indonesia, Japan, Nigeria, and Cyprus, amongst others.

Many of the largest exporting nations also appear in the list of prominent importing countries (e.g., China, United States, India and Sudan). This is a crucial point, as it underscores that transmission cables do not necessarily lead to nations being wholly reliant upon others for their supplies. Instead, cross-border power exchanges can be mutually beneficial, emphasising the importance of technical and diplomatic cooperation between states. Multinational power systems can enhance energy security for countries by diversifying national supply portfolios and improving system reliability through network redundancy. Global energy policies are currently on a pathway toward ever increasing protectionism with growing frictions between competing global economies. Yet, as our analysis is beginning to show, a net-zero transition could be substantially more prosperous—technically, economically, and socially—through integrated global power systems.

Everyone's a winner

China: The clean energy powerhouse

China has contributed more than one-third to global transmission expansion over the last decade. According to the IEA, China has constructed over 500,000 km of transmission lines in this period. Today, China’s transmission capacity stands at around 225 GW. By 2040, our analysis shows that building out an additional 508 GW of transmission capacity—both within the country and extending to its neighbours—is the most cost-effective pathway to achieve net-zero. Accompanying this build-out is an astonishing 7800 GW capacity mix of zero-carbon power, up from an existing 1200 GW. This is made up of solar PV (44%), wind (16%), hydro (15%), and nuclear (4%). The total cost of China’s infrastructure deployment in the GUS scenario is $USD 635 billion. Yet, reinforcing transmission cables in China could save the country $USD 557 billion in the transition costs compared to a scenario where transmission capacity is not expanded beyond today’s levels.

India: Transmission brings new export revenues

Allowing reinforcement of transmission infrastructure sees India substantially bolstering its transmission capacity (+52 GW), enabling it to become a significant exporter of clean power, particularly from Southern and Eastern India. While the GUS pathway is a more costly proposition for India than the NGS case, it would yield new export revenue opportunities for the country. In 2040, India’s power system capacity reached 2700 GW under GUS, which is split between solar PV (29%), onshore wind (45%), offshore wind (4%) hydro (9%), and nuclear (2%).

Figure 3. Major transmission lines and zero-carbon capacity projections for China and India in 2021 and 2040 under the GUS scenario

Sub-Saharan Africa: To connect or not to connect?

Given the limited transmission capacity across the continent today, sub-Saharan Africa (SSA) faces a unique question: should a power transmission system be constructed to connect up the continent or do better solutions exist? Previous analyses have shown that standalone or mini grid systems could be the best path forward for SSA. Nonetheless, our analysis reveals a significant expansion in transmission capacity across SSA. From today’s transmission capacity (17.1 GW), SSA’s transmission cables are reinforced to achieve a combined capacity of 74 GW, representing a more than four-fold increase. Alongside this, a zero-carbon portfolio of 460 GW is built-out, comprising solar PV (18.3%), onshore wind (20%), offshore wind (11%) hydro (31%), and nuclear (2.5%). In total, SSA’s net-zero transition for the power sector costs $USD 2397 billion if transmission is expanded. While this is more costly than the NGS scenario, it provides SSA new export revenues, though these aren’t captured by our modelling for any region yet

Figure 4. Major transmission lines and zero-carbon capacity projections for South East Asia in 2021 and 2040 under the GUS scenario

South East Asia: Transmission is key to unlocking the transition

Perhaps nowhere is it clearer that transmission can unlock the energy transition than in South East Asia. The GUS pathway reveals a striking result for the region: massive expansions of zero-carbon power generation, facilitated by a regionally integrated power network. The total power capacity mix amounts to 2800 GW, comprising solar PV (29%), onshore wind (33%), offshore wind (10%), hydro (9%), and nuclear (1%). Meanwhile, several SEA countries (e.g., Thailand, Indonesia, and Laos) become net-exporters of clean power by 2040.

Figure 6. Major transmission lines and zero-carbon capacity projections for Africa in 2040 under the GUS scenario

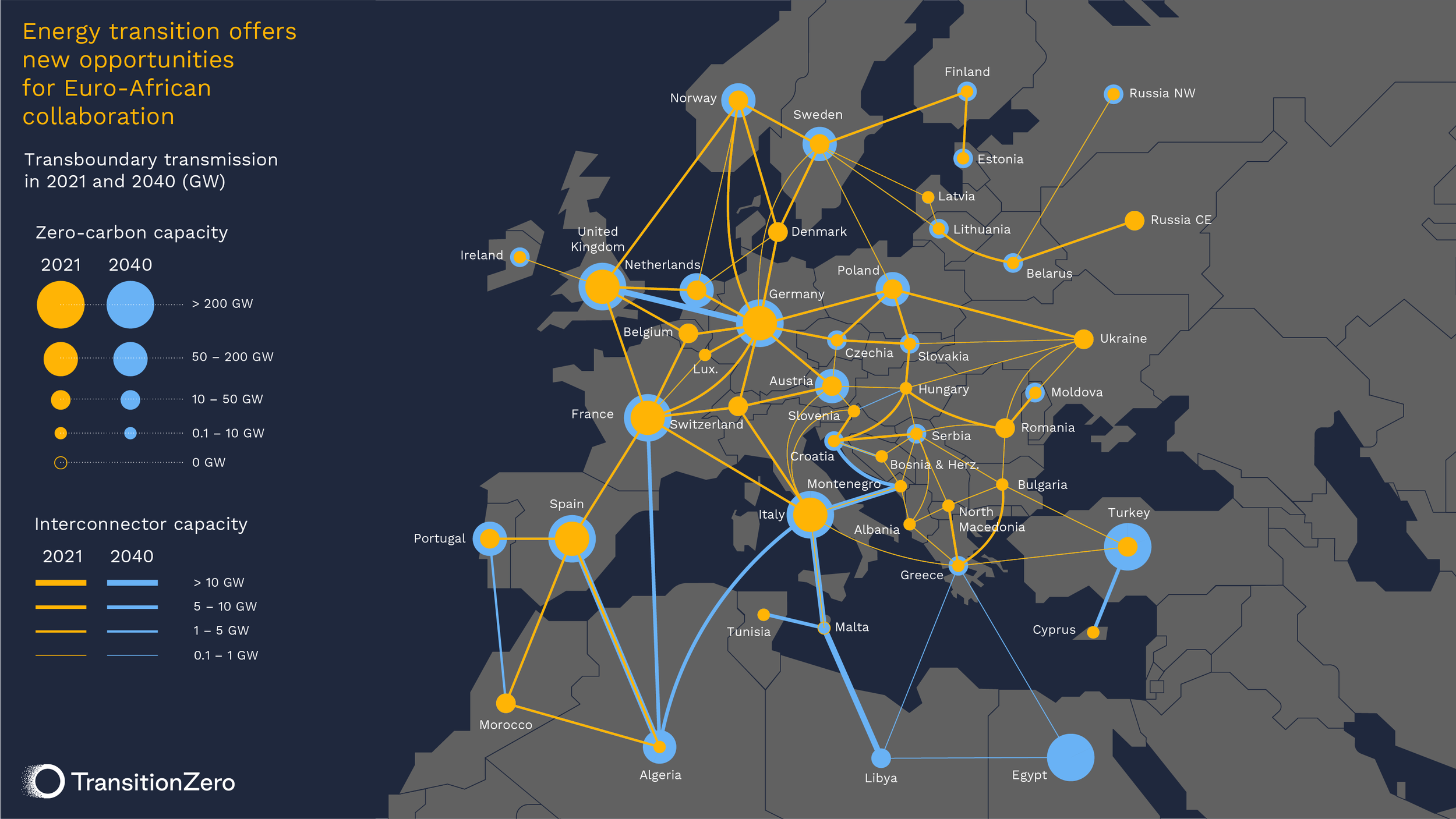

Europe: The defining decade

Europe already hosts the world’s largest integrated power system. Its +400 interconnectors serve 600 million people everyday. Russia’s invasion of Ukraine has accelerated the irreversible momentum of zero-carbon energy in Europe, meaning its existing network will need to keep pace with the change. Actions in this decade will shape the course of the continent’s transition. Our analysis suggests greater cooperation with North African economies could unlock a more cost-effective transition for Europe. Morocco, Algeria, Tunisia, Libya, Egypt and Turkey all become important trading partners for Europe under the GUS scenario. The total capacity of transmission across Europe reaches 419 GW by 2040, up from around 31 GW today. This is accompanied by a 3000 GW power system made up of solar PV (32%), onshore wind (19%), offshore wind (15%) hydro (17%), and nuclear (6%).

Figure 7. Major transmission lines and zero-carbon capacity projections for Europe in 2021 and 2040 under the GUS scenario

Latin America: The new Pan-American Highway

Transmission cables spanning a distance of nearly 10,000 km see power flowing across Latin America and beyond, from Argentina to the United States. The total grid capacity amounts to 48 GW in 2040, which represents a doubling of today’s transmission capacity. This is accompanied by a combined generation mix of solar PV (16%), onshore wind (16%), offshore wind (10%) hydropower (50%), and nuclear (1%) with a bulk capacity of 330 GW. Overall, reinforcing transmission avoids around 70 GW of zero-carbon generation. The total cost of the net-zero transition for Latin America is $USD 774 billion under the GUS scenario, which is 19% less than that under the NGS pathway.

Figure 8. Major transmission lines and zero-carbon capacity projections for Latin America in 2021 and 2040 under the GUS scenario

Middle East and North Africa (MENA): The clean electricity hub of the world

The MENA region has often served as a global hub for trade over previous centuries. Our analysis shows that the region could do this again by acting as the clean power hub between Asia, Europe and Africa. We see massive build-outs of zero-carbon power across MENA to 2040, with the total capacity reaching 2000 GW, made up of solar PV (27%), onshore wind (33%), offshore wind (10%) hydro (2.5%), and nuclear (1%). Transmission cables not only save the MENA region $USD 890 billion in transition costs, but also allow much of the region to become a net exporter of electricity

Figure 5. Major transmission lines and zero-carbon capacity projections for MENA in 2021 and 2040 under the GUS scenario

North America: A trillion dollar relationship

The GUS scenario brings significantly closer alignment in the power systems of the United States and Canada. There is limited integration in the Canadian-USA power system today. Yet, by 2040, the total grid capacity across the two regions reaches 419 GW, representing a 13-fold increase relative to today. Power is generated by a system made up of solar PV (28%), onshore wind (26%), offshore wind (16%), hydro (9%), geothermal (1.6%) and nuclear (2%) with a combined capacity of 3100 GW. Cross-border power flows primarily from central Canada to the Midwest and Western regions of the United States. Canada’s natural resource potential sees it become a net exporter of electricity. In total, transition costs in North America reduce by $USD 1.5 trillion if transmission cables are reinforced - a 16% reduction compared to a scenario with no transmission expansion.

Figure 9. Major transmission lines and zero-carbon capacity projections for North America in 2021 and 2040 under the GUS scenario

Cables to change the world

Our analysis modelled 400 potential transmission pathways globally that could deliver net-zero while saving trillions of dollars. However, given limitations in resources and time, it’s crucial for decision makers to prioritise the most viable options that firmly steer the power sector towards achieving a net-zero trajectory.

The question then becomes: how and where should we spend the first dollar on transmission lines? We have compiled a shortlist of ten transmission lines that have the potential to make the biggest impact on the power sector’s path to net-zero. We went through our global results database to select at least one cable for each region, accounting for the potential cost saving, energy access delivered and existing regional policies. It is important to note that capacities presented here are not for individual cables, rather an aggregation of all transmission between the associated systems. This is our shortlist:

Enablers that could accelerate greater transmission rollout

Urgently reform planning and permitting processes

Currently, new transmission projects can take as long as a decade to build. As a consequence, thousands of shovel-ready clean energy projects are currently blocked as they wait for grid connection, which could impede the energy transition.

It is now widely recognised that planning reform is urgently required, not only to enable greater transmission rollouts, but also to speed-up the deployment of other critical infrastructure such as solar and wind power. On a positive note, electricity system operators have already outlined the reforms that need to take place.

Set long-term national targets for transmission

Creating energy master plans and setting future targets for renewable energy adoption have become standard practice. Around 164 countries have now adopted at least one renewable energy target. Yet, these plans and targets often neglect the transmission sector despite the criticality of grids to greater uptake of zero-carbon energy. Planning grids is a large-scale and multi-year undertaking. It is therefore essential that grids be incorporated into national decarbonisation plans with clear pathways, milestones and review processes set up to ensure timely delivery and policy adjustments.

Attract investment by identifying the no-regrets options

Building the grids of the future will require trillions of dollars of capital, meaning blended finance mechanisms will likely be essential. Uncertainty and risk perception still hinder capital flows into projects that will enable the energy transition. It is therefore essential for energy managers to identify no-regrets transmission projects that can offer reliable returns. Energy systems models can help derive a merit-order list of options that could bring the greatest impact.

Prepare labour force and supply chains

The energy transition is global. New transmission will therefore be built at unprecedented scales around the world simultaneously. This will create stiff competition within labour markets, as well as for key materials (aluminium and copper) and supply chains. Without robust planning, these factors could leave countries short on workers, materials or manufacturing infrastructure, impeding the energy transition regionally.

Governments urgently need to devise worker training and upskilling programmes to ensure a strong workforce is ready to build the clean infrastructure of tomorrow. Alongside this, national industrial strategies could help identify new opportunities for production of transition goods.

Ensure public stakeholder engagement and inclusion

Public support and community buy-in is vital for building new power cables. Planners and developers will need to minimise the negative impacts to local communities due to the net-zero transition to maintain popular support. It is critical that people understand the reasons for change and are given a platform to voice their concerns. Perhaps most importantly, the benefits of the transition should be shared with the communities that host key infrastructure.

Assess the possibility of international cooperation

Simply put, decarbonising the power sector globally without international cooperation might be impossible. Yet, in a time of increasing political isolationism, multilateral coordination on energy resource development may seem unlikely. However, even in the most fractious of regions and times, countries have cooperated on natural resource management and the environment for decades and continue to do so. From the water treaties between Pakistan and India to the Paris Climate Agreement itself, which continues to see almost 200 countries convene annually to clarify and implement the science of climate change. Without international cooperation, perhaps none of action on climate mitigation and adaptation to date could have taken place. Countries therefore must make concerted efforts to explore opportunities to coordinate grid and clean energy development with their neighbours, while also balancing their energy sovereignty.

Grids are the missing link

The key message here is clear: bolstering our grid infrastructure could collectively save the world’s economy trillions of dollars on the journey to net-zero. Although not quantified here, the social and economic benefits of power integration could be greater still as new jobs, markets and multilateral trade relationships are created.

Notes

[1] It is important to note that our study relies on an energy systems model that aims to reduce the total cost of the global interconnected power system over a given period of time. The results shown in this study are meant to be indicative, not definitive. The numbers, such as interconnector capacities and system costs, are intended to represent relative benefits, overall trends, and system dynamics.

[2] Negative values for system cost differences indicate that the associated country/region is a net exporter of electricity in the GUS. These countries/regions build power generation capacity greater than their own needs in order to export electricity. The system costs presented here capture the associated investment costs of this additional capacity but not the revenues from the electricity trade – therefore leading to negative values.